Learn about the Essential Benefits of Insurance for Economic Safety and Worry-free Living

Insurance is crucial in safeguarding against life's unexpected difficulties. It offers a structure for fiscal safety, offering protection from accidents, health issues, and property damage. Familiarizing oneself with the different forms of protection offered can significantly affect one's fiscal health. Moreover, choosing prudently about insurance policies guarantees that individuals and families are sufficiently ready for unforeseen occurrences. As the conversation unfolds, it is apparent how these factors contribute to a feeling of safety and peace of mind.

Understanding Different Types of Insurance Coverage

While many individuals acknowledge the value of insurance, they tend to ignore the wide range of policies accessible. Each type has a unique function and addresses different needs. Health insurance, for instance, gives fiscal support for healthcare costs, making sure you can get to necessary healthcare services. Car coverage shields against financial setbacks related to car crashes, theft, and damage, giving assurance on the road. Homeowners insurance protects assets against risks like fire, theft, and catastrophic events, fostering a sense of security for homeowners. Additionally, a life policy provides monetary protection for beneficiaries in the event of the policyholder's demise. Alternative types, such as tenant coverage and liability coverage, handle unique circumstances that individuals may face in their lives. Grasping these varied choices is crucial for making informed decisions about individual fiscal safety and achieving long-term security.

The Importance of Insurance in Risk Management

Insurance is fundamental in risk management by offering an organized method to lessening potential financial losses. Both companies and people employ insurance as a forward-thinking step to transfer risk from themselves to an insurer, in turn limiting their exposure to unforeseen events. By analyzing potential hazards, insurance products are customized to meet specific needs, whether it be property damage, liability, or medical concerns.

In risk management, insurance acts as a fiscal safeguard. It enables businesses and individuals to rebound after unforeseen problems without facing massive financial strain. In addition, the predictability of insurance costs allows for better budgeting and financial planning. By incorporating insurance into an all-encompassing risk mitigation plan, organizations can concentrate on advancement and expansion, assured that they are shielded against future challenges. In conclusion, the role of insurance in risk management builds strength, ensuring stability in the face of the unknown.

Securing Your Family's Financial Future

When families prioritize securing their finances, they create a safety net that shields those they care about against unpredictable problems. Insurance is essential in this effort, offering various policies that protect families from major financial strain resulting from unexpected events, accidents, or sickness. Health insurance, specifically, covers healthcare bills, making certain that families are able to get required medical care without destroying their financial security.

Life insurance provides additional security by giving a lump sum payment to recipients if the policyholder passes away, enabling families to keep their current lifestyle. Homeowners or renters insurance protects against property loss or damage, further securing a family's financial future.

Peace of Mind Through Comprehensive Coverage

Extensive coverage offers families a robust framework for safeguarding their financial well-being, boosting the confidence that comes from being certain that they are ready for a variety of potential risks. With thorough insurance policies, individuals can navigate life’s uncertainties without the constant worry of unforeseen expenses. This sense of security allows families to concentrate on their everyday routines, promoting greater happiness and stronger bonds.

Furthermore, comprehensive protection typically involves various aspects such as health, property, and liability protection, which together help create a more secure financial outlook. When families are confident that they have adequate protection, they are more likely to pursue opportunities, such as furthering education or purchasing property, without the risk of jeopardizing their investments due to unforeseen circumstances. In the end, the confidence offered by comprehensive protection gives families the ability to live completely, certain that a secure net exists for life's unpredictable moments.

Choosing Insurance Policies Wisely and Knowledgeably

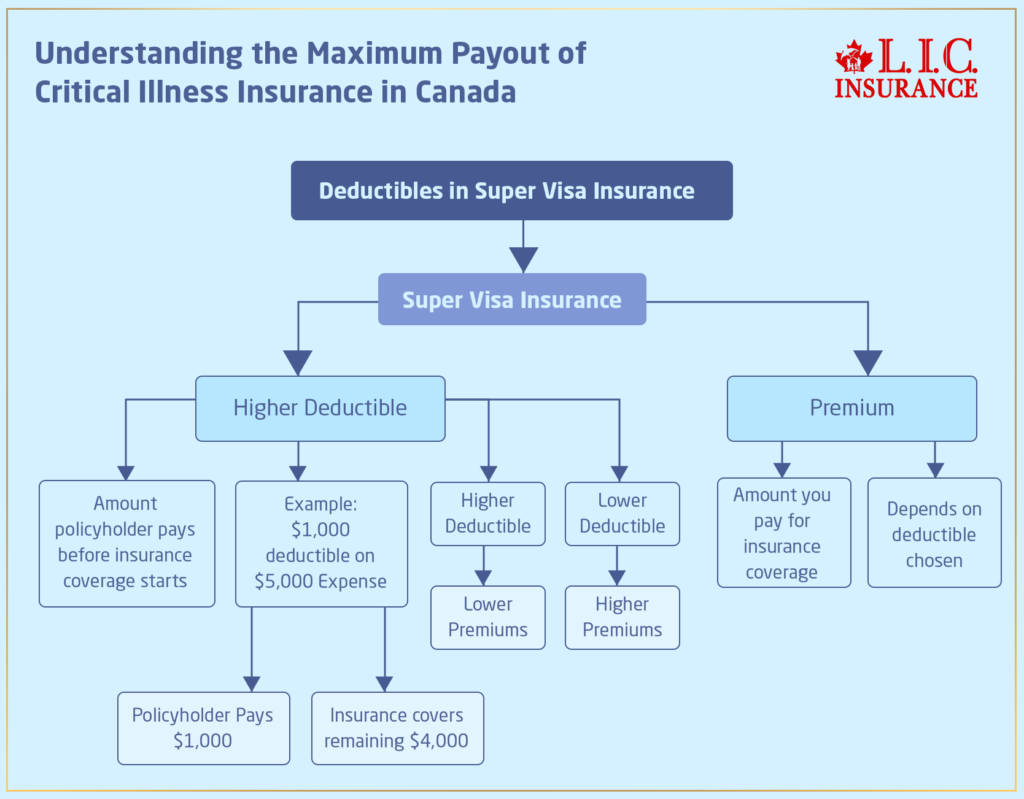

How can individuals guarantee they are making the best choices when selecting insurance policies? To determine this, careful study is necessary. Consumers must begin by evaluating their specific needs and economic circumstances, which helps them to figure out the kind of coverage needed. Reviewing various insurance carriers is vital, as it highlights differences in costs, excess amounts, and policy maximums. In addition, checking client testimonials and checking objective evaluations offers clarity regarding the trustworthiness of insurance companies.

Understanding policy terms is crucially important; policyholders should comprehend what is covered and all limitations so there are no unexpected costs down the road. Consulting professional insurance representatives can further clarify complex options and help in tailoring policies to suit individual situations. Ultimately, making informed decisions about insurance policies requires thoughtful evaluation of choices, diligent research, and understanding individual necessities, ensuring ideal protection and monetary stability.

FAQs

How Do Insurance Premiums Vary Based on Perceived Risks?

Policy costs differ based on risk factors such as age, health, location, and history of filing claims. Higher perceived risks typically result in increased premiums, while lower risks may result in price reductions and more favorable rates for policyholders.

Am I Able to Modify My Coverage Mid-Policy?

Yes, individuals can change their insurance coverage mid-policy. However, adjustments may affect premiums and need the copyright's authorization. It's advisable to review the policy terms and consult with an insurance representative for guidance.

What Happens if I Miss a Premium Payment?

Should a payment be overlooked, the policyholder might be given a grace period to make the payment. Not paying could lead to policy cancellation, termination of benefits, and problems securing future coverage.

Are There Tax Benefits for Having Certain Types of Insurance?

Indeed, particular insurance policies, such as health and long-term care insurance, might yield tax savings. Premiums can sometimes be deducted from taxable income, contributing to potential savings and savings opportunities for clients.

How Does Claims Processes Differ Between Insurance Agencies?

Claims processes vary greatly between insurance carriers, with some requiring detailed documentation and others offering get started easy online filing. Timeliness, customer service, and openness also change, influencing the total experience for policyholders during the claims process.